In today’s fluctuating economic landscape, securing one’s financial future has never been more crucial. Managing personal finances effectively is a journey, not a destination, demanding both strategy and discipline.

This article offers a step-by-step guide to discuss some of the best steps to improve your personal economy, from budgeting basics to savvy investment tactics.

Whether you’re aiming to eliminate debt, save for the future, or enhance your financial literacy, these strategies will empower you to take control of your finances and work towards building a more secure and prosperous future.

Best Steps to Improve Your Personal Economy

In today’s rapid-paced world, achieving financial security has become a primary concern. Controlling your personal economy effectively requires strategic thinking and coherent planning.

Here, we’ve devised a comprehensive guide to enhance your financial prowess in handling debt, making investments, and saving for the future. This guide will get you to understand the strategies needed to elevate your personal economy effectively.

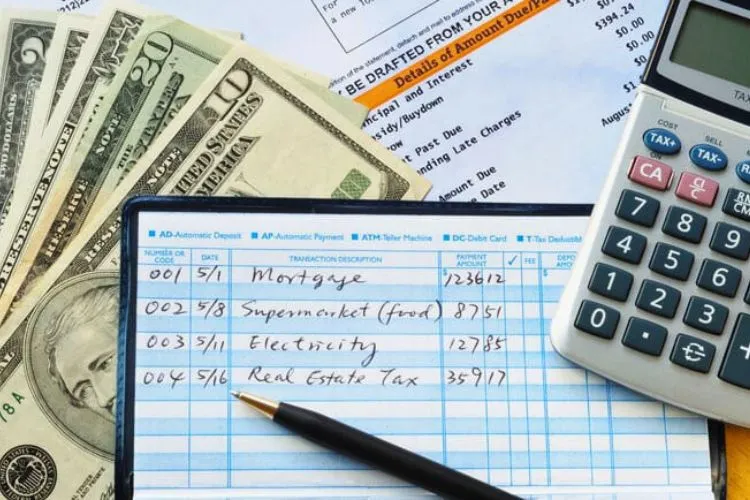

Construct a Budget

Your journey towards financial security begins with the establishment of a solid budget. It’s akin to a roadmap guiding you through your income and expenses. Begin by calculating your total monthly post-tax income, then itemize and quantify all your expenditures.

Do not overlook expenses that only occur annually or irregularly; divide their sum by 12 to estimate their monthly cost. Once you’ve created your budget, you’ll be able to recognize unnecessary expenses you can cut out and increase your savings.

Build an Emergency Fund

Life is loaded with unexpected surprises, some of which can prove financially costly. An emergency fund serves as a financial buffer should any unforeseen expenses occur. Such expenses could range from sudden medical expenses, an unanticipated car repair, or even an unexpected job loss. Ideally, try to accumulate at least three to six months’ worth of living expenses.

Reduce and Eliminate Debt

Debt reduction is a crucial step towards improving your personal economy. High-interest debt, in particular, can severely hamper your financial growth by eating away at your potential savings and investment funds. Here’s how to tackle it:

Snowball Method

- List all Debts: Start by listing out all your debts from smallest to largest, regardless of interest rate.

- Minimum Payments: Pay the minimum amount on all your debts except for the smallest one.

- Focus on Smallest Debt: Allocate as much extra money as possible to the smallest debt until it is completely paid off.

- Roll Over Payments: Once the smallest debt is paid off, use the funds you were allocating to it (including the minimum payment) to pay off the next smallest debt. Continue this process, “snowballing” the payments towards larger debts as each smaller one is paid off.

- Motivation: This method helps in building motivation and momentum as you see debts being cleared one after the other.

Avalanche Method

- List all Debts: List your debts based on the interest rate, from highest to lowest.

- Minimum Payments: Make minimum payments on all your debts.

- Focus on Highest Interest Debt: Direct as much extra money as possible to the debt with the highest interest rate.

- Roll Over Payments: After the highest interest debt is paid off, apply its payment to the debt with the next highest interest rate.

- Save Money: This method saves money in the long run by reducing the amount of interest you pay.

Implementing these strategies requires discipline and a solid budget. Prioritize your expenses, cut unnecessary spending, and redirect those funds towards debt reduction.

Increase Your Income

Boosting your income is equally important when trying to improve your personal economy. Here are ways to increase your earnings:

Freelancing

- Identify Your Skills: Determine what skills you have that are in demand and can be offered as freelance services, such as writing, graphic design, or programming.

- Market Yourself: Use platforms like Upwork, Freelancer, or LinkedIn to find freelance work.

- Set Reasonable Rates: Research what others in your field are charging and set competitive rates.

- Manage Your Time: Balance your freelancing with your primary job to avoid burnout.

Starting a Side Hustle

- Identify a Niche: Find a market need that matches your interests or hobbies, such as crafting, tutoring, or digital marketing.

- Plan Your Business: Create a simple business plan outlining your services, pricing, and marketing strategy.

- Legalities and Finances: Ensure you have the proper licenses and have set up a way to manage your finances separately from your personal money.

- Promotion: Use social media and word-of-mouth to promote your side hustle.

Working Overtime

- Company Policies: Understand your employer’s policies on overtime. Some companies offer time-and-a-half or double pay for overtime work.

- Manage Your Health: Ensure that working overtime does not negatively affect your health or well-being.

- Balance: Find a balance between the extra hours and your personal life to avoid burnout.

The additional income from these activities should be strategically allocated towards paying off debts, building your emergency fund, or investing in your future. Always maintain a balance between earning more and living a healthy, sustainable lifestyle.

Develop a Savings Plan

As the saying goes, “A penny saved is a penny earned.” Building a robust savings plan is crucial in improving your personal economy. Evaluate your financial goals and create a plan to achieve them. This could be saving for retirement, a new house, or for higher education.

Invest Wisely

Investing wisely is a cornerstone of building a solid financial foundation. It’s the process of putting your money into vehicles with the potential of generating income or growing in value over time. As inflation erodes purchasing power, investing becomes essential to not just preserve but also to enhance your wealth.

However, it’s paramount to approach investing with both knowledge and caution, as each opportunity carries its own set of risks. Below, we delve deeper into various investment avenues including stocks, bonds, mutual funds, and real estate, and provide insights on how to navigate these options wisely.

Understanding Different Investment Avenues

- Stocks: When you buy stocks, you’re purchasing a small piece of ownership in a company. Stocks offer high growth potential but come with significant volatility and risks. The key to successfully investing in stocks is thorough research and a well-considered strategy, such as diversification, which can help mitigate risk.

- Bonds: Bonds are essentially loans you give to governments or corporations, which then pay you back with interest over a set period. They’re generally considered safer than stocks but offer lower returns. Bonds can be a good way to generate steady, albeit modest, income and diversify your investment portfolio.

- Mutual Funds: Mutual funds pool money from many investors to purchase a broad portfolio of stocks, bonds, or other securities. They offer the advantage of diversification and professional management. However, they come with fees, and the returns are not guaranteed. It’s crucial to understand the fund’s objectives, the fees involved, and the track record of the fund manager before investing.

- Real Estate: Investing in real estate can provide income, capital appreciation, and diversification. This can be achieved through purchasing physical properties or real estate investment trusts (REITs), which offer a more liquid and less capital-intensive means of real estate investment. The market can be influenced by various factors, including economic trends and interest rates, making it essential to conduct diligent research.

Key Investment Principles

- Educate Yourself: Before diving into any investment, grasp the fundamentals of each option. Resources abound online, including courses, articles, and tutorials that can of

- fer invaluable insights into the world of investment.

- Risk Assessment: Understand your risk tolerance—how much volatility are you comfortable enduring for the potential of higher returns? A diversified portfolio can help manage risk, spreading out potential losses across different investment types.

- Long-Term Perspective: Investing is not about making a quick profit but about growing your wealth over time. A long-term perspective helps you weather the inevitable ups and downs of the market.

- Regular Investment and Review: Consider setting up a regular investment plan, taking advantage of the concept of dollar-cost averaging, which can potentially reduce the impact of volatility. Additionally, review your investments periodically to ensure they align with your financial goals and adjust as necessary.

Mitigating Risks

Investing wisely also means knowing how to mitigate risks. Diversification across different assets and industries is crucial. Moreover, staying informed about market trends and understanding the factors that impact your investments will help you make educated decisions. Embrace patience and discipline, as reactionary or emotional decisions often undermine investment strategies.

In conclusion, wise investing is an indispensable part of securing a resilient financial future. By educating yourself about the various investment avenues, understanding your own risk tolerance, and adhering to the principles of diversification and long-term growth, you can make informed decisions that contribute to the overall health of your personal economy.

Investing is not without its challenges, but with careful planning and perseverance, it can be an effective way to achieve financial independence and security.

Understand and Improve Your Credit Score

Your credit score plays a vital role in your financial life. It’s what lenders look at when determining whether they want to give you a loan or a credit card, and at what interest rate. Ensuring your credit score is in a good position can save you a considerable amount of money in the long term.

Continue Your Financial Education

Your personal economy is an ongoing project. To succeed, one should be informed about financial trends, markets, and investment options. Regularly read books, watch videos, and follow reputable financial advice sources to maintain and develop your financial literacy.

By incorporating these steps into your financial planning, you can improve your personal economy and feel more secure in your financial future.

It’s never too early or too late to start bettering your financial health, and this guide is your roadmap to success. Every step, no matter how small, takes you closer to your financial goals.

Conclusion:

In conclusion, fortifying your personal economy is a multifaceted endeavor requiring persistence, education, and savvy financial habits.

Whether you’re crafting a detailed budget, bolstering your savings, or exploring new income streams, each strategy plays a pivotal role in achieving monetary stability.

Remember, the goal is not just to weather economic storms but to thrive; making informed decisions aligned with your financial goals can propel you towards lasting prosperity.

Begin with small, manageable steps today, and over time, these seeds of fiscal responsibility will grow into a sturdy, flourishing tree of financial freedom.